Repairing your credit score can be the key to unlocking financial freedom. A low credit history can limit your options for loans, credit cards, and even housing. By taking steps to strengthen your credit, you can open up a world of possibilities. A strong credit score demonstrates dependability to lenders, allowing you to qualify for better interest rates and more favorable loan terms. This translates in significant savings over the lifetime of your debt and enables you greater financial control.

- Initiate by reviewing your credit report for errors and disputing any inaccuracies.

- Fulfill your payments on time, every time.

- Decrease your credit card balances to improve your debt-to-income ratio.

Remember, credit repair is a marathon, not a sprint. Persist with your efforts and you'll be well on your way to achieving financial freedom.

Navigating Bad Credit: A Guide to Private Lenders

If conventional lenders have turned your loan applications due to bad credit, don't despair. Private lenders offer an option for borrowers with subpar credit histories. While private loans often come with higher interest rates and stricter conditions, they can be a feasible way to finance the funds you need.

Before embarking on a private loan, it's important to do your due diligence. Contrast different lenders, scrutinize their rates, and grasp the ramifications of borrowing. Building a strong rapport with a reputable private lender can prove beneficial in the long run.

- Consult lenders specializing in bad credit loans

- Review your credit report and address any mistakes

- Prepare necessary documentation, including proof of income and dwelling

Restore Your Credit, Secure Your Future

Damaged credit can hinder your financial opportunities. It can lead to higher rates on loans and debit cards. A low rating can even influence your ability to rent an apartment or get a job.

But don't despair. There are ways you can take to restore your credit and create a brighter financial future. Start by reviewing your credit report for inaccuracies and refuting any that you find.

Also, work on boosting your credit habits by making payments on time and keeping your debit utilization low. Be determined – repairing your credit takes time, but the benefits are well worth the effort.

From Bad Credit towards Better Borrowing Power

Rebuilding your credit score can seem like a daunting task, but it's definitely achievable. With dedication and a strategic approach, you can transform your financial situation also unlock better borrowing opportunities. Start by inspecting your credit report for any errors and disputing them with the credit bureaus. Make on-time payments on all your existing debts. Consider applying for a secured credit card to build a positive payment history. Remember, consistency is key when it comes to credit repair. It takes time and effort, but the rewards of improved borrowing power are well worth it.

- Prioritize on reducing your debt-to-credit ratio.

- Avoid opening new credit accounts too frequently.

- Monitor your progress regularly and celebrate your successes.

Exclusive Lender Solutions for Damaged Credit Histories

Navigating the financial world with a damaged credit history can be challenging. Traditional lenders often turn down applications from borrowers with less-than-perfect credit scores, leaving many feeling discouraged. However, there are specialized lending solutions available that focus to individuals with low credit. These lenders appreciate the unique circumstances faced by borrowers with damaged credit and present flexible arrangements that can help them obtain their financial goals.

Private lenders frequently conduct a thorough review of your personal situation, taking into consideration factors beyond just your credit score. This implies that you may have a higher chance of approval even with a less-than-ideal credit history.

Furthermore, private lenders often offer competitive interest rates and repayment plans that can be tailored to your individual needs. This adaptability can make private lending a suitable option for individuals who are looking to improve their creditworthiness or access financing for important purchases or investments.

It's important to understand that while private lenders can be a valuable resource, it's essential to research your options carefully.

Contrast different lenders, examine their terms and conditions, and confirm that you fully understand the repayment obligations before entering into any agreement.

By taking a proactive approach and exploring your options, you can find private lending solutions that can help you overcome the challenges of a damaged credit history and achieve your financial goals.

Seize Your Finances: The Path to Credit Repair

Your credit score is more than just a number; it's the key/gatekeeper/gateway to your financial future. A strong credit score can unlock amazing/favorable/better interest rates on loans, facilitate/enable/secure favorable lease terms, and even influence insurance/rental/employment opportunities. Conversely, a low credit score can create significant obstacles/hardships/challenges. But the good news is that you have the power to repair/improve/strengthen your credit and chart/forge/create a more secure financial path.

It all starts with understanding your credit report and identifying areas that need attention/improvement/focus. Request free copies from each of the three major credit bureaus: Experian, Equifax, and TransUnion. Carefully analyze/review/scrutinize your reports for any inaccuracies/errors/discrepancies and dispute them promptly.

Building good credit is a journey/process/marathon, not a sprint. Consistently make on-time payments, utilize/manage/control your credit cards responsibly, and keep your credit utilization/debt levels/balance sheets low. Diversify/Expand/Cultivate your credit mix by utilizing/applying for/opening different types of credit, such as installment loans or credit cards, while remaining mindful of your overall debt.

Remember, taking control of your finances is an investment/commitment/obligation that will pay dividends throughout your life. By following these steps and staying consistent/dedicated/persistent, you can successfully repair your credit and achieve check here your financial goals.

Kel Mitchell Then & Now!

Kel Mitchell Then & Now! Marla Sokoloff Then & Now!

Marla Sokoloff Then & Now! Freddie Prinze Jr. Then & Now!

Freddie Prinze Jr. Then & Now! Kelly Le Brock Then & Now!

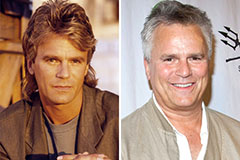

Kelly Le Brock Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!